Strong end to record-breaking year – but uncertainty ahead

As Big Ben’s bongs rang out, a record-breaking year for the residential housing market gave way to an uncertain New Year.

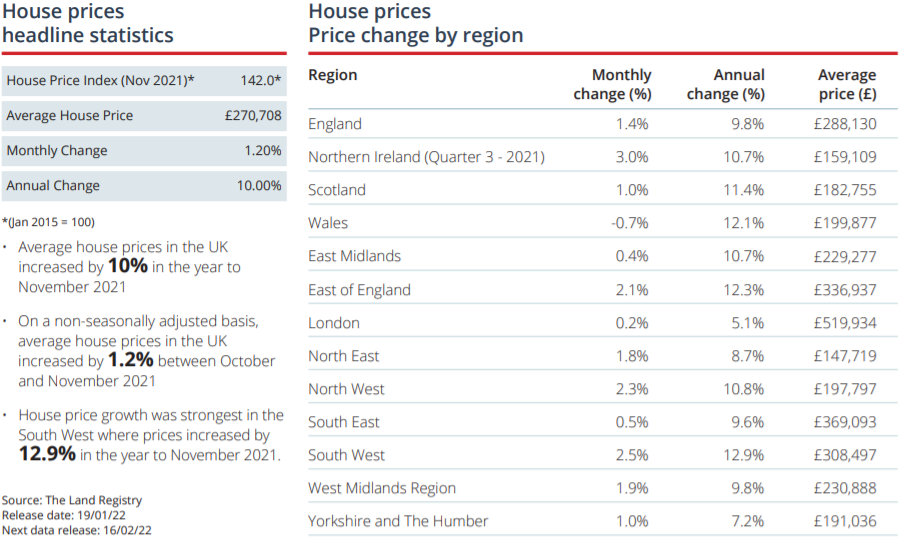

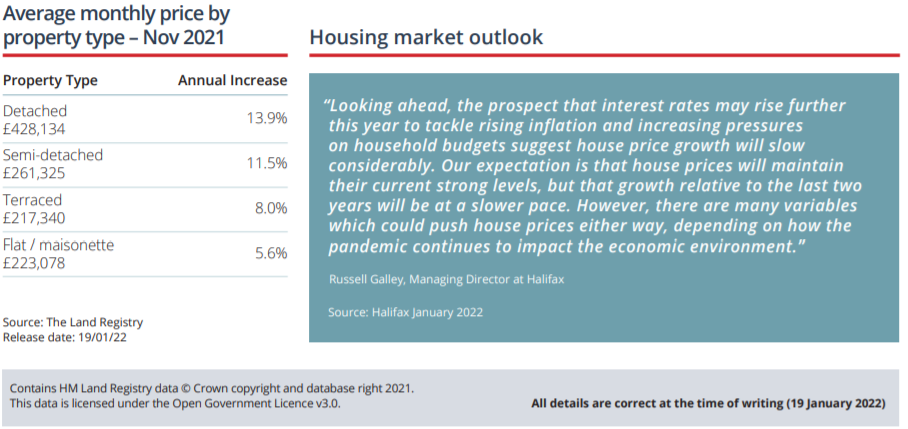

Completed transactions to November totalled 1.36 million, which means the number of homes sold in 2021 will reach levels not seen since before the global financial crisis. Persistently high demand and constrained supply have led buyers to snap up available properties; the average number of viewings held before an offer was accepted was just 13 in November 2021, according to Knight Frank, the lowest level since December 2020.

Savills expects this heightened activity to drop off slightly in 2022. The first few months are likely to be busy given that sales agreed remained at elevated levels in November, according to TwentyCi. However, Bank of England data shows that mortgage approvals have returned to pre-pandemic levels, while the Institution for Chartered Surveyors data shows that supply has been falling since April 2021; a combination of factors which experts suggest could lead to leaner months ahead.

Government reacts to cladding crisis

The government has announced its long-awaited cladding plans in the form of a four-point plan and a three-word slogan, ‘Developers Must Pay’.

The plan includes:

The government has warned developers that if industry fails to take responsibility, it will ‘impose a solution in law.’ Secretary of State for Levelling Up, Michael Gove, said, “More than 4 years after the Grenfell Tower tragedy, the system is broken. Leaseholders are trapped, unable to sell their homes and facing vast bills. But the developers and cladding companies who caused the problem are dodging accountability… From today, we are bringing this scandal to an end.”

FTBs soar to 20-year high

The number of first-time buyers (FTBs) skyrocketed in 2021, with an estimated 408,379 people purchasing their first home during the year, according to Yorkshire Building Society (YBS).

This is a 35% year-on-year rise and the first time since before the global financial crisis that the number of FTBs has surpassed 400,000. Falling unemployment, low interest rates and low deposit mortgage deals have all helped to boost demand.

FTBs in high value areas also benefited from the government’s Stamp Duty holiday, receiving additional relief on properties up to £500,000. Another pandemic bonus for FTBs was the larger deposits that many were able to save due to reduced expenditures during lockdowns.

Nitesh Patel, Strategic Economist at YBS, called the FTB market in 2021 “extraordinary” and added, “Low borrowing costs is an important factor and the increased availability of more low deposit mortgages has also been an enabler mostly for first-time buyers.”

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.