| GDP unexpectedly rose by 0.7% in Q1 2025, driven by services, production and investment growth | The Bank of England cut interest rates despite inflation jumping to a 15-month high at 3.5% | The UK labour market shows weakness as payrolls drop and unemployment edges up to 4.5% |

First quarter gross domestic product (GDP) data published last month by the Office for National Statistics (ONS) showed the UK economy grew more strongly than had been predicted during the first three months of 2025.

According to the latest GDP statistics, economic output rose by 0.7% between January and March, up sharply from a rate of 0.1% in the final three months of 2024. This figure was also higher than economists had been expecting, with the consensus forecast from a Reuters poll pointing to a quarterly growth rate of 0.6%.

ONS said the economy’s strong first quarter performance was largely driven by the services sector, which includes businesses in areas such as retail, hospitality and finance. The production sector, however, also saw significant growth as firms brought activity forward in order to beat the imposition of US tariffs, while business investment grew strongly too, recording its largest quarterly growth rate for two years.

Updated growth forecasts released towards the end of last month by the International Monetary Fund (IMF) were nudged higher in order to reflect the strong first quarter data. The international soothsayer now predicts the UK economy will expand by 1.2% across the whole of 2025, with growth expected to hit 1.4% next year, in spite of headwinds from US tariffs which are expected to reduce annual output by 0.3%.

Despite the upgrade, the IMF forecast still assumes the strong performance seen early this year will prove short-lived. Survey evidence also points to a sharp second quarter slowdown, with data from the S&P Global UK Purchasing Managers’ Index hinting at a possible second quarter contraction. While last month’s flash Composite Output figure was up on the previous month’s level ‒ suggesting an easing of the downturn in May ‒ it did still remain below the 50.0 threshold that denotes contraction in business activity.

Last month saw the Bank of England (BoE) sanction a further cut in interest rates while data released a couple of weeks after that decision showed the headline rate of inflation now standing at a 15-month high.

Following its latest meeting, which concluded on 7 May, the BoE’s nine-member Monetary Policy Committee (MPC) voted by a 5-4 majority to reduce rates by 0.25 percentage points, taking Bank Rate down to 4.25%. Unexpectedly though, there was a three-way split among policymakers: while two of the four dissenting voices actually voted for a larger half-point reduction, the other two dissenters preferred to leave rates unchanged.

Analysts had not expected any votes to be cast against a rate cut and the fact that two MPC members did, sent a more hawkish message in relation to the speed of any future monetary policy easing. A recent Reuters poll, however, did find that most economists still expect two more cuts this year, with the consensus viewing August as the most likely date for the next reduction.

Commenting after announcing the MPC’s decision, BoE Governor Andrew Bailey also reaffirmed his expectation that rates will continue on a downward trajectory. While Mr Bailey stressed that he was not prepared to “give predictions as to when and how much,” he did state that he was “still of the view that the path, gradually and carefully, is downwards.”

The latest official inflation statistics released two weeks after the MPC meeting, though, showed that the annual headline CPI rate jumped to 3.5% in April from 2.6% in March. This figure was above market expectations and represents the highest reading since January 2024. It also clearly leaves inflation significantly above the BoE’s 2% target, and led some economists to suggest that any future rate cuts may need to be more gradual.

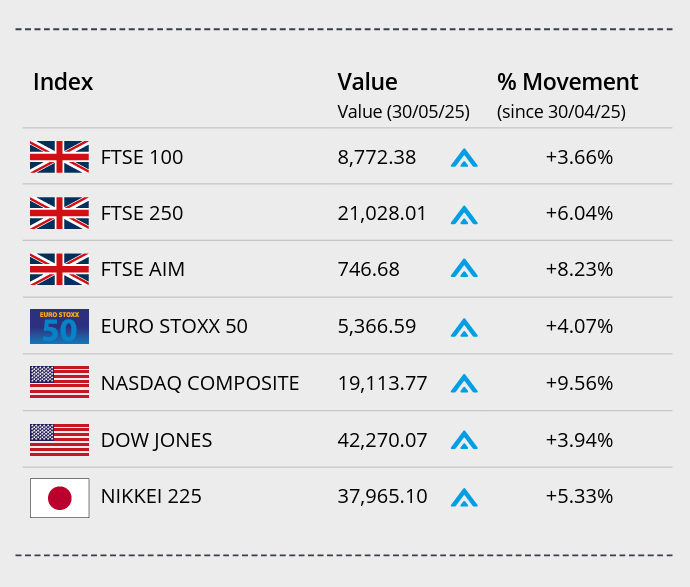

At the end of May, the FTSE 100 rose while US and Asian stocks fell as investors digested new tariff uncertainty. As the month drew to a close, President Trump accused China of breaking their tariff truce, he was also defending potential roadblocks to his trade policies from the US courts.

In the UK, the FTSE 100 index closed the month on 8,772.38, a gain of 3.66%. The mid-cap focused FTSE 250 closed May up 6.04% on 21,028.01, while the FTSE AIM closed on 746.68, a monthly gain of 8.23%.

The Dow Jones closed May up 3.94% on 42,270.07, while the tech-orientated NASDAQ closed the month up 9.56% on 19,113.77. May marked the best month for the NASDAQ since November 2023.

On the continent, the Euro Stoxx 50 closed May 4.07% higher on 5,366.59. In Japan, the Nikkei 225 ended the month on 37,965.10, a monthly gain of 5.33%.

On the foreign exchanges, the euro closed the month at €1.18 against sterling. The US dollar closed at $1.34 against sterling and at $1.13 against the euro.

Brent Crude closed May trading at around $60 a barrel, a monthly loss of just over 1.00%. The oil price fell at month end pressured by uncertainty over US trade policy developments and expectations of increased supply from OPEC+. Gold closed the month trading around $3,291 a troy ounce, a monthly loss of 0.77%. The price edged lower at month end as traders positioned themselves ahead of the release of US inflation data.

The latest official retail sales statistics showed sales volumes grew strongly in April, while more recent survey evidence points to a pick-up in optimism among the consumer base.

ONS data released last month revealed that retail sales volumes grew by 1.2% in April; this figure was significantly above analysts’ expectations and marked a fourth successive monthly increase in sales volumes. ONS noted that April’s warm weather provided a boost to sales across most sectors with supermarkets, butchers, bakers, alcohol and tobacco stores all enjoying a particularly positive month.

Data from GfK’s most recent consumer confidence survey also offered some cheer to the retail sector, reporting an improvement in consumer morale. Driven by improved optimism in households’ outlook for both their own finances as well as wider economic prospects, May’s headline figure rose to -20 from a figure of -23 the previous month.

Last month’s CBI Distributive Trades Survey, however, did report a sharp decline in confidence among retailers with its gauge of business sentiment dropping to its lowest level since May 2020. CBI Lead Economist Ben Jones described May’s results as “fairly downbeat” adding that some parts of the retail sector were continuing to struggle with “fragile consumer demand.”

More signs of a weakening jobs market

Labour market data released last month revealed further signs of cooling in the UK jobs market, with the number of workers on payrolls and vacancies both declining and the unemployment rate ticking higher.

Provisional tax office statistics published by ONS showed that the number of employees on companies’ payrolls fell by an estimated 33,000 in April following a 47,000 drop in March. The overall level of job vacancies also fell once again, with 42,000 fewer reported in the February to April period; this represents the largest decline in over a year.

The data also revealed an increase in the unemployment rate, which rose to 4.5% in the three months to March; this compares to 4.4% during the previous three-month period. ONS did, however, warn that its unemployment figures still need to be treated with some caution due to increased data volatility stemming from low survey response rates.

A Chartered Institute of Personnel and Development survey released last month also reinforced the picture of a cooling jobs market; the survey’s headline gauge of employment intentions fell to a record low outside of the pandemic, as rising employment costs and uncertainty in the global economy forced many organisations to scale back recruitment.

All details are correct at the time of writing (02 June 2025)

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.